The Lesson of Pop Mart Paradise

Source:

Author:

Release time:

2025-08-25

Click to view details

Come here ↓ to discover new trends in cultural tourism

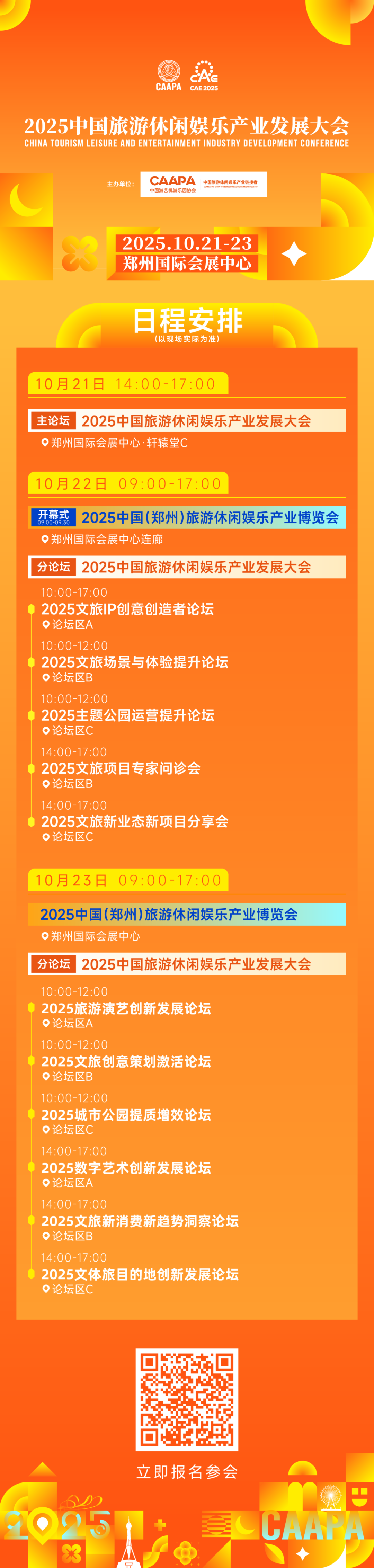

2025 China Tourism, Leisure and Entertainment Industry Development Conference

Join the grand event with 1000+ leading cultural tourism enterprises

See you in Zhengzhou, October 21-23!

▲

Author | Yang Feng

Editor-in-Chief | Yang Ming

Editor | Liu Kaiye

"Another traffic bubble" "A blind box company running a park is pure fantasy" "The excitement lasts only three months" "Lack of interactive experience" ...These have been the most common doubts in the market since Pop Mart City Park officially opened in September 2023.

As of today, nearly two years have passed, how is Pop Mart Park doing?

In the first half of this year, Pop Mart City Park quietly added green fences, which once made people think it was a sign of closure. However, in fact—

At Pop Mart's mid-2025 performance conference held on August 20, founder Wang Ning stated, Although about 50% of the park area was closed for upgrades in the first half of the year, both visitor traffic and revenue exceeded last year's full-year figures. Pop Mart City Park version 1.5 is expected to debut next year (2026), and the second phase of the park will be twice the size of the first phase.

It is evident that Pop Mart Park not only "survived" the traffic dividend period but also launched a second phase. Although it has gained experience and lessons, it is exploring its own development path. Wang Ning said that the city park achieved profitability within one year of operation, which is not easy, but at the same time, the team has a deeper understanding of the city park. "There were some mistakes in the previous planning due to lack of experience, and we will make adjustments and plans soon."

Pop Mart Park General Manager Hu Jian further explained that previously the company learned from large parks, but these parks are mostly located in suburbs. "City parks are in city centers, a park you can visit after work." Hu Jian said this means the operation ideas, amusement facilities, hardware investment, etc., differ from large parks, requiring us to explore our own operation path. "The current park is still far from our ideal state."

From the case of Pop Mart Park, I want to discuss a truly important issue: how to break through the "bias" in thinking to understand the new consumer language—those consumption grammars reinvented by young people. Rejecting it means rejecting new customer groups and new waves, possibly causing theme parks, commercial real estate, and even the cultural tourism industry to miss a thinking iteration and business evolution that should belong to them.

Understandable "Bias"

The bias discussed here is more of a fixed mindset. From the perspective of traditional park operation, being pessimistic about Pop Mart Park seems very natural and reasonable for the following reasons:

• Genetic Defect. A company that started with blind boxes lacks offline operation experience and team. Retail and entertainment operations are completely different concepts, and the success rate of such crossovers is extremely low.

• IP Shortcomings. Although Pop Mart's IPs are popular, they lack strong storytelling and emotional connection. Unlike Disney's time-tested classic narratives, in the content industry, this is called "insufficient IP depth."

• Model Doubts. Theme parks require huge investment and long-term return cycles, which contradicts Pop Mart's light-asset, fast-turnover business model.

• Competitive Pressure. The Beijing theme park market is saturated, with international giants like Universal Studios and strong local brands like Happy Valley. A new entrant has no chance of winning.

• Single Business Format. Covering only 40,000 square meters, less than one-tenth the size of typical theme parks, it can only be made into a large retail experience store without deep experiential content.

The combination of these five "defects" makes Pop Mart Park look like a "traffic floodgate"—harvesting the online blind box popularity offline once again, then quickly fading: Pop Mart = traffic product, traffic product offline = accelerated monetization & depreciation.

Unexpected Success

Facing many doubts, in October 2023, Pop Mart Park's first month operation report was released: Visitor Traffic 10 Ten thousand visits, average stay duration 4.32 hours, secondary consumption ratio over 70%。

In fact, Pop Mart Park's core strategy is not relying on large amusement facilities but creating immersive IP experiences. The park features themed areas of well-known IPs such as MOLLY, DIMOO, SKULLPANDA, creating a tangible trendy toy world through scene restoration, interactive experiences, and limited edition products. This design not only reduces operating costs but more importantly highlights Pop Mart's IP advantages.

"Looking forward to co-creating with fans, being the most attentive official" said Pop Mart Park General Manager Hu Jian before the opening.

It is not hard to see that behind Pop Mart Park's success operates an efficient "experience economy" and "fan economy" system. Contemporary consumers, especially Generation Z, are no longer satisfied with simply purchasing products but seek more unique identity recognition and social experiences through products. The park provides a physical experience that online blind boxes cannot replace, meeting fans' needs for deep interaction with IP. The core fan group forms an important support for Pop Mart Park. Meanwhile, Pop Mart uses membership systems and big data analysis to accurately grasp fan preferences, providing personalized experiences to maintain high revisit rates and secondary consumption levels.

Pop Mart regards the park as part of the entire ecosystem rather than an independent business. The park, as the ultimate scene for IP experience, in turn promotes blind box sales and IP development, forming a virtuous cycle. In terms of operation mode, Pop Mart Park adopts a combination model of "park + retail + dining." Visitors not only purchase tickets but also consume limited edition products and themed dining within the park, creating a diversified revenue structure and enhancing the park project's independent development capability.

The industry needs a "demystification"

Over the past decade, the narrative of theme park success or failure seems confined to the Disney and Universal Studios models. However, in my view, there is no unchanging textbook template. The industry needs a "demystification" action to liberate thinking. "Demystification" does not deny the classics but restores them to methodologies rather than dogma.

• Disney's "storytelling power" is worth learning from, but the story doesn't necessarily have to start from Mickey Mouse in 1928;

• Universal's "immersive technology" is worth learning from, but immersion doesn't necessarily require a billion-dollar Decepticon roller coaster;

• The "format combination" of shopping centers is worth learning from, but the combination doesn't necessarily have to be the three-part theory of "anchor store + secondary anchor store + dining support."

Only after demystification can we see that traffic, internet celebrities, and cross-industry elements are essentially new factors of production—they, like capital, land, and technology, can be deconstructed, reorganized, and redesigned. From this, we should at least understand the following points:

1. Don't rush to label new models

Terms like "internet celebrity" and "check-in" are neutral; their lifespan depends on whether operators are willing to continuously iterate. Labeling them rigidly is equivalent to closing off the space for trial and error.

2. Don't misunderstand "deep cultivation" as "slow cultivation"

Deep cultivation means having a deep understanding of users, not slow actions or long timeframes. Flexible supply chains, membership tokens, and IP operations are all deep cultivation, just at a faster pace.

3. Don't narrow "high quality" to "high cost"

The core of high quality is "high emotional intensity," not "high cost." A hidden hanging card from Pop Mart that causes screams is no less than the weightlessness of a roller coaster—the key is whether you can convert those screams into repeat purchases.

Let fresh blood flow in

Today's theme parks and even the cultural tourism industry are most scarce not in land or money, but in "atypical practitioners" who bring new models and new tactics.

Pop Mart Park does not overturn anyone; it only reminds us:

When the supply side is still measuring the new world with old rulers, the demand side has already written the answer with new grammar. Don't rush to mock "internet celebrities," nor rush to mythologize the "classics." Treat traffic as a consumer language to be compiled and cross-industry as an iterative product experiment. Only then will the industry grow more Pop Marts and iQiyis.

Come here ↓ to discover new trends in cultural tourism

2025 China Tourism, Leisure and Entertainment Industry Development Conference

Join the grand event with 1000+ leading cultural tourism enterprises

See you in Zhengzhou, October 21-23!

Key words: