Without cultural and tourism investment, how can there be operation?

Source:

Author:

Release time:

2025-08-26

Click to view details

Come here ↓ to discover new trends in cultural tourism

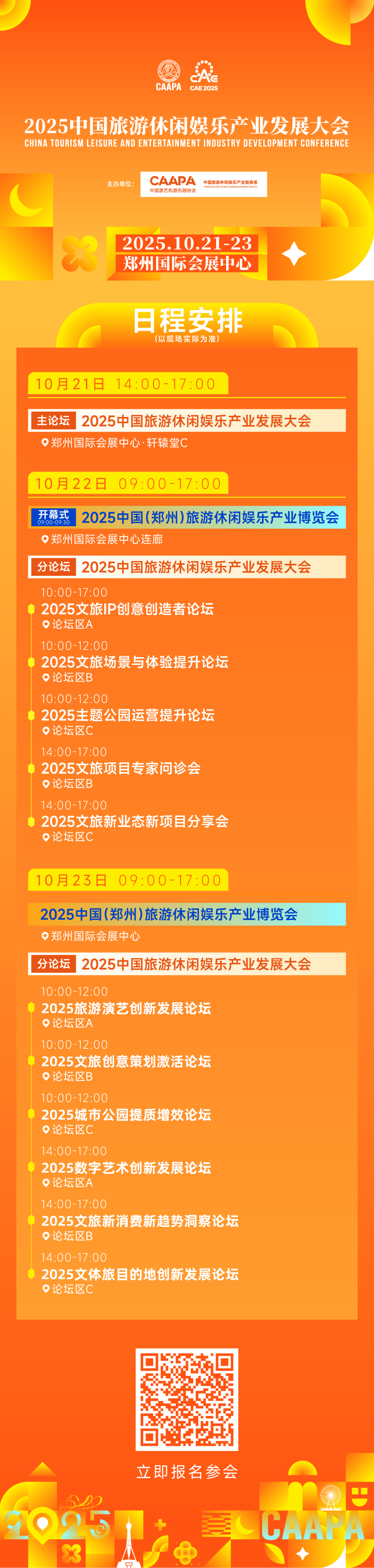

2025 China Tourism Leisure and Entertainment Industry Development Conference

Join over 1000 leading cultural tourism enterprises to share the grand event and opportunities

See you in Zhengzhou, October 21-23!

▲

Author | Investment Soldier

Editor-in-Chief | Yang Ming

Editor | Liu Kaiye

In recent years, "operation pre-positioning" has almost become a buzzword in the cultural tourism industry. From developers and design institutes to content providers, everyone emphasizes "think through operations before starting construction." However, despite the loud voices, cases of unfinished projects and modifications have not decreased much. What is the reason?

"Operation pre-positioning" is essentially an idealized process design. It assumes that "as long as the operational logic is embedded early in the planning and construction stages, later detours can be minimized or success ensured." Setting aside the practical difficulties of tight schedules and multi-party coordination, the uniqueness of cultural tourism projects lies in the fact that operational logic needs to be validated by capital logic. Without certainty in investment scale, pace, and structure, even the most perfect operational plan is just a simulation— It's not that operation is unimportant, but only by first learning to tell stories in financial terms and attracting substantial quality capital can operational capabilities realize more stories.

The importance of "operation pre-positioning" needs no further explanation, but the story of "capital pre-positioning" is rarely told.

Capital's Correct Roles — Blood Supplier, Architect, Risk Controller

1. Blood Supplier — from "Construction Period" to "Full Lifecycle"

Traditional cultural tourism investment focuses on the construction period, with 80% of funds used for civil engineering, landscaping, and hardware. This leads to "peak at opening," and later operations can only survive on ticket sales and rent. True capital pre-positioning requires investors to break down funds across the "full lifecycle":

Startup phase: land preparation, infrastructure, IP acquisition;

Ramp-up phase: content incubation, marketing, team integration;

Maturity phase: operation management, product iteration, membership systems, asset securitization

Taking Japan's Hoshino Group as an example, its core of asset-light expansion is the "renovation fund + operation revenue sharing": the fund bears early renovation costs, Hoshino operates and guarantees a certain percentage of minimum returns. Capital is no longer a "one-time payment" but a "long-term partner" deeply tied to operations.

Hoshino Group Aomoriya

2. Architect — Restructuring Business Models with Financial Instruments

The deadlock in cultural tourism projects lies in the contradiction between "slow returns" and "fast money". The solution is to split assets into financial products with different risk-return levels.

Heavy asset side: through REITs (infrastructure public REITs) or REIT-like products, package stable cash flow assets like hotels and parking lots for listing to shorten exit cycles;

Light asset side: exchange brand and management output for equity, for example, Kaiyuan Tourism divides its hotels into "self-owned properties" (REITs-ized) and "management output" (charging 3%-5% revenue share);

Content side: test the market with "crowdfunding + pre-sale," such as the Moganshan homestay cluster locking in tens of millions in cash flow early through the "co-builder plan," reducing trial-and-error costs.

The role of capital here is not simply "giving money," but designing a precise structure of "who bears risk and who enjoys returns."

3. Risk Controller — Using Data to Pierce Through the "Operation Illusion"

The biggest risk in the cultural tourism industry is the "operation illusion"— creating false prosperity during the planning stage using benchmark cases and estimation models. The ultimate meaning of capital pre-positioning is to make "money" the coldest touchstone:

During a financing roadshow for an ancient town project, the operator claimed "daily visitor flow could reach 15,000." The capital side required "ticket revenue pledge" as a risk control condition. Final calculations showed 23,000 visitors were needed to cover principal and interest, forcing the project to reduce commercial area and add secondary consumption scenarios;

An investor in an immersive theater required "core actor contract rate to reach XX percent before releasing funds," forcing the operator to lock in the content team early to avoid "staff turnover right after opening."

When capital questions operations using IRR (Internal Rate of Return), DSCR (Debt Service Coverage Ratio), and other indicators, all "stories" must be converted into verifiable data.

Capital's core interrogation — Where does the money come from, where is it invested, and how to exit

No matter how moving the operational story is, capital cannot avoid three basic questions: where does the money come from (funding source), where is it invested (investment direction), and how to exit (exit mechanism). These three questions form the basic framework for cultural tourism investment decisions and are the core criteria for evaluating any cultural tourism project’s investment value. Only with clear answers to these questions does operation pre-positioning have practical significance. Here I share some preliminary views.

1、 Where does the money come from — Multi-level funding puzzle

The core difficulty of cultural tourism investment lies in long cycles and slow returns, thus requiring a multi-level funding combination:

Government capital: for example, local governments support large resorts through special bonds and PPP models to ensure infrastructure (roads, water, electricity, sewage treatment) is prioritized. A scenic spot in Guizhou leveraged local urban investment companies to tap special bond funds, solving a 500 million yuan infrastructure gap at startup.

Financial capital: commercial bank loans, industrial funds, insurance funds, etc., preferring stable cash flow assets. A certain ancient town in Lijiang, Yunnan, was built through bank loans and repaid with ticket cash flow, showing clear capital preference.

Social capital and "smart money": strategic investors, internet platforms, IP parties—they not only invest money but also bring resources. For example, Alibaba's investment in "Xixi Paradise" uses Alipay traffic and big data to drive user operations.

Own funds.

2、 Where to invest —Precise investment to avoid "big and all"

Once cultural and tourism funds are in place, the allocation direction must be clear; otherwise, it is easy to fall into the trap of "focusing on construction while neglecting operation."

Hardware foundation, steady and solid: capital tends to prioritize investment in essential assets such as hotels, cable cars, and parking lots because these assets have stable cash flow and are easy to securitize.

Secondary consumption, profit highland: data shows that over 40% of the profits of Disney and Universal Studios come from secondary consumption such as dining, performances, and retail.

Innovative scenarios, long-term leverage: night tours, immersive theaters, study camps, and other innovative consumption scenarios may not require large investments but can effectively increase user dwell time and repurchase rates.

3、 How to exit —The "decent exit" of capital

The ultimate concern of capital is not "whether the project is fun," but "whether it can exit safely." The exit path determines whether capital is willing to enter.

Equity exit: common among early investors, transferring equity to longer-term funds or strategic investors after the project operation stabilizes and cash flow is clear.

Asset securitization: standardizing cash flows such as ticket revenue, hotel income, and rent into tradable financial products through REITs-like structures, public REITs, or ABS.

Overall or partial equity acquisition: the most common exit method, especially suitable for small and medium homestay clusters or cultural tourism projects, ultimately selling overall or partial equity to large cultural tourism groups.

The "Three Invests and Three No-Invests" of investment, practical discipline of cultural tourism capital

In cultural tourism project investment, passion and vision are important, but clear investment discipline is the key to distinguishing success from failure. Here, I share a "Three Invests and Three No-Invests" principle for reference only.

1、 Invest "Operational leverage," be cautious about "hardware piling up"

Invest in "soft power" that can continuously create value, namely top-tier operation teams, high-quality content IP, digital capabilities, and service systems. These are core to enhancing experience, attracting traffic, and achieving profitability; beware of blindly investing huge sums in building massive hardware facilities. Overreliance on "steel and concrete" leads to heavy assets and tight cash flow, and if operations lag, it becomes hard-to-monetize negative assets.

2. Invest in "friends of time," be cautious about " opportunists ”

Invest in scarce resources with long-term value (such as unique landscapes, cultural heritage) and brands that appreciate over time. The pursuit is projects with endogenous growth momentum and lasting vitality; reject speculative projects that rely solely on short-term policy benefits without real market demand. Policies change easily, speculation is highly risky, and when the tide recedes, only a mess remains.

3. Invest in "securitizable assets," be cautious about "only talking about passion"

Invest in assets with clear ownership, stable cash flow, and future capitalization potential (such as REITs, acquisitions). The essence of capital requires clear exit paths and return models; avoid projects that only have grand passion and dreams but lack feasible business models and profitability. Never just talk about passion; passion that cannot be commercialized is a fatal trap for investment.

The "capitalized survival" of operators, from subcontractors to partners

When capital becomes a prerequisite, the role of operators must also evolve:

1. From "service providers" to "co-founders"

In the traditional model, operators are subcontractors (or subordinate teams) of developers, charging management fees (or salaries) according to contracts. After capital is introduced, operators (teams) can bind interests through "technical equity" or "performance betting." This model has been widely applied in many projects and will not be elaborated here.

2. From "content suppliers" to "asset operators"

The success of the Wuzhen Theatre Festival is not about "how many stars were invited," but that Chen Xianghong's team transformed "theatre IP" into an "asset appreciation tool"—enhancing the scenic area's premium through the festival, driving the appreciation of all surrounding assets. Operators must establish a "content-asset-capital" conversion model, rather than just organizing events.

3. From "empiricism" to "data assets"

Capital increasingly values the "data capability" of operators. A certain cultural tourism group requires cooperating operators to connect to its SaaS system, uploading real-time data on visitor flow, consumption, repurchase, etc., as "asset proof" for the next round of financing. Operators need to turn experience into tradable data assets, rather than relying on personal "practical experience" or reputation endorsements.

The "spiral ascent" of capital and operation

Capital is not the enemy of operation but a "beast" that operation must tame. Only by embedding capital structure, cash flow models, and exit paths into the operation DNA before project launch can capital be leveraged, and "operation prepositioning" will not become a sand table game.

In fact, whether it is "operation prepositioning" or "capital prepositioning", there is no contradiction between the two, but clear division of labor is necessary, respecting professionalism, allowing professionals to maximize effectiveness in their roles, capital is no longer just a voice and status, operation is no longer just taking over "revitalization," letting capital support lay the foundation for operation, and operation's data feed back to capital valuation, only then can the two enter a "spiral ascent" channel of value, helping cultural tourism projects break out of the vicious cycle of "construction - abandonment - adjustment - resale."

Come here ↓ to discover new trends in cultural tourism

2025 China Tourism Leisure and Entertainment Industry Development Conference

Join over 1000 leading cultural tourism enterprises in a grand event

See you in Zhengzhou, October 21-23!

Key words: