The world's hottest IP lands in its first theme park

Source:

Author:

Release time:

2025-07-25

Click to view details

Discover great travel content here↓

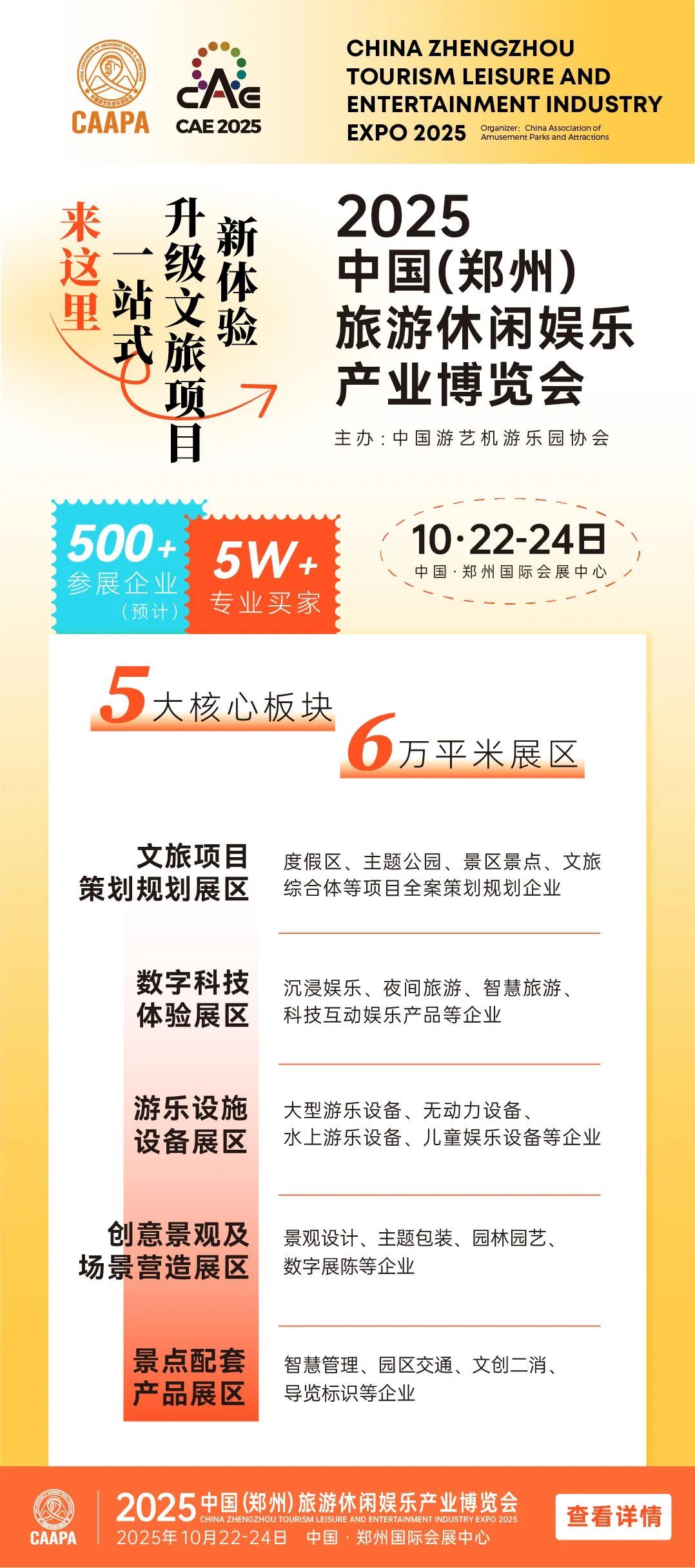

2025 China (Zhengzhou) Tourism, Leisure and Entertainment Industry Expo

500+ Exhibiting companies to help you One-stop Create and upgrade Tourism Projects

Author | Flying Sheep Editor-in-chief | Yang Ming

Editor | Jing Xiangyuan

Source | Theme Park World

On July 22, The Pokémon Company announced in a video format a series of updates on Pokémon's future plans, including more details on the upcoming game, Pokémon Legends Z-A, a stop-motion animation program, "Psyduck and Pikachu's Adventures," in collaboration with Aardman Animations, the creators of Shaun the Sheep, and a preview of the next Pokémon World Championships to be held in California in mid-August. Most importantly, they revealed details and progress on the PokéPark Kanto project.

How much money does the enduring Pokémon franchise make?

Pokémon is a brand image jointly developed by the Japanese game companies Game Freak, Creatures Inc., and Nintendo. Although Nintendo is the largest shareholder of the Pokémon brand, it is independent of other Nintendo brands and is managed and operated by The Pokémon Company.

1) Main series games (9th generation released, cumulative sales exceeding 400 million);

2) Trading card game (43 billion cards sold, some rare cards worth millions of dollars);

3) Animation and theatrical versions (Ash and Pikachu have been with the world for 25 years);

4) Pokémon Center, Pokémon Café, and collaborative apparel retail systems;

5) Diversified revenue structure spanning games, merchandise, animation, theme parks, and events.

From children to adults, from Japan to the world, Pokémon has achieved "all-age, cross-cultural appeal." According to License Global, Pokémon's 2023 retail revenue reached US$10.8 billion, ranking seventh among the world's top brands. According to the latest financial report, its 2024 fiscal year global licensing revenue reached nearly US$100 billion, securing the top spot in the global licensing revenue rankings, with a net profit of 20.4 billion RMB.

Table: Estimated Revenue Structure of Pokémon Brand

Behind the Development of PokéPark Kanto

This is a joint venture project funded by The Pokémon Company, Yomiuri Shimbun, and Yomiuriland, located in Yomiuriland in Tokyo, covering an area of 2.6 hectares. Reportedly costing an estimated 150 million RMB, it is the world's first permanent outdoor Pokémon theme park, scheduled to open in spring 2026.

Judging from Pokémon's revenue and the scale of the project, Pokémon doesn't seem to be aiming to make money from this project. Pokémon's official statement is that they hope players can put down their electronics and experience an adventure more real than the game. Here, there are no screens, no joysticks, no virtual reality, only forests, wind, sunshine, and Pokémon hidden in the bushes.

In the theme park industry, this seems more like a brand showcase for fans. This concept directly influences the product form of PokéPark Kanto. Unlike traditional theme parks, it focuses on a "nature exploration immersion experience," presenting several characteristics:

1) Not a fast-paced amusement park or Universal Studios-style experience, but closer to natural ecological leisure;

2) Based on the first generation "Kanto region," focusing on nostalgia and attempting to awaken the Pokémon origins of the 80s and 90s generations;

3) No "screen-swiping," but more emphasis on "exploration," highlighting observation and experience, returning to childhood innocence;

This project focuses on two immersive areas: the Pokémon Forest Area and the Grass Town Area.

In Pokémon Forest visitors will be able to embark on an exploration trail approximately 500 meters long, traversing through real natural terrains such as forests, caves, and valleys, observing the Pokémon ecosystem in different habitats. The focus here is not on amusement facilities, but on exploration and observation, allowing visitors to become true Pokémon Trainers , experiencing the surprise of encountering Pokémon in the wild, just like in the animation!

Grass Town Area with "Trainer Life" as its theme, is designed as a warm and lively town streetscape, full of interaction and entertainment. It features an official Pokémon Center store, a market, a dojo training ground, a character meet-and-greet area, and two amusement facilities. It also plans to feature a Milotic themed fountain square. The overall atmosphere blends the joy of a theme park with a fan exchange space, aiming to become a popular destination for families and fans 。

From the results, it seems that Pokémon, as the copyright holder, is more powerful.

What did Yomiuriland get?

Yomiuriland, as a veteran amusement park in Japan, may not be as famous as Tokyo Disney and Universal Studios Osaka, or even Nagoya's parks, but since its opening in 1964, it has remained stable, accompanying the growth of generations of Tokyo citizens, and still receives over 1.8 million visitors annually.

However, behind its stability is the difficulty in effectively breaking through its operations. Yomiuriland is located in the Tama Hills, actually far from the center of Tokyo. The park has made many efforts to attract customers, such as:

1) Making full use of the advantages of the hillside terrain, integrating amusement and ecological experiences, such as riding the Bandit roller coaster at 110 km/h through thousands of cherry trees;

2) Attempt diversification to cover all age groups: thrilling roller coasters, family-friendly areas, summer heat escape, and winter light shows;

3) Continuously introduce new attractions: such as the Goodjoba!! creative area, water park, and gemstone light festival, adapting to trends and family-oriented cultural needs;

4) Regarding ticket prices, lower the entry barrier by adopting a combination of entry tickets and amusement package tickets;

Through in-depth cooperation with the Pokémon IP , Yomiuriland is expected to gain significant brand value and traffic increase

For example:

1) Brand image enhancement and differentiated competitiveness

The Yomiuriland brand is further modernized, establishing a stronger emotional connection with younger generations. PokéPark KANTO becomes its differentiating highlight, offering more freshness and buzz compared to competitors, strengthening the park's long-term appeal.

2) Direct traffic conversion and social exposure

For a long time, Yomiuriland has mainly targeted local customers. Pokémon's inherent global fan appeal is expected to attract a number of overseas tourists to Japan for a "pilgrimage".

3) Enhanced thematic consumption

Pokémon's greatest advantage lies in its content stickiness and unique retail offerings. PokéPark KANTO, located within Yomiuriland, offers a more thematically rich and interactive experience compared to traditional amusement facilities, such as the Pokémon Center store, themed dining, and themed parades, all of which will bring more consumption scenarios and secondary income sources to the park.

Is the Pokémon Park the Japanese version of POP LAND?

They seem to have a logical consistency:

1) Both are roughly the same scale of renovation projects, That is, empowerment of existing scenarios. The former, as a themed area of Yomiuriland, covers an area of 26,000 square meters and has an investment of approximately 150 million yuan; the latter is located in Chaoyang Park, covering an area of 40,000 square meters, with an official investment of approximately 300 million yuan, serving as a park-within-a-park to meet the needs of short-distance leisure and check-in;

2) IP driven, That is, using its own IP as the core, extending the value of the IP through park scenarios. The former relies on the super IP "Pokémon," recreating the adventure world from the game/animation through scenarios, while the latter uses trendy IPs such as MOLLY and LABUBU as protagonists to build a fairytale narrative space;

3) Emphasizing immersive experiences, PokéPark combines Yomiuriland's ecological environment to design outdoor interactive projects such as Pokémon catching and battles. POP LAND uses AR games and audio-visual installations (such as the "Wish Journey" underground theater) to enhance visitor participation and deepen emotional connections through scenario-based tasks;

4) A "goods market" for young fans, Both areas have sales areas for IP products as an important component. The former has designed a Pokémon Center store selling limited-edition peripherals, while the latter has a limited-edition trendy toy store (such as MEGA collector's editions and park-exclusive products) inside the castle. products).

However, the core differences between the two are also very obvious, Pokémon is a comprehensive multimedia IP with a strong narrative worldview. Developed in cooperation with the Yomiuri Group, it relies on existing large-scale amusement parks and is more geared towards global fan tourists; while Pop Mart is a trendy toy IP that relies on emotional resonance and artistic design, independently developed and operated, embedded in urban parks, and mainly targets the domestic trendy toy fan base in China.

In short, PokéPark Kanto represents the physical expansion of traditional pan-entertainment IPs: relying on mature multimedia narratives and a global fan base, strengthening the IP ecosystem through large-scale collaborative projects;

Pop Mart's urban amusement park creates a lightweight immersive model for trendy toy IPs: using "emotional consumption" as its core, creating high-frequency, low-threshold "brand pilgrimage sites" through urban renewal projects.

Both verify two paths for IP cross-border real-world entertainment: giant IP ecosystem extension vs. emerging IP vertical cultivation.

At the same time, for more Yomiurilands or Chaoyang Parks, embracing IP seems to be a good choice...

Discover great travel content here↓

2025 China (Zhengzhou) Tourism, Leisure and Entertainment Industry Expo

500+ Exhibiting companies to help you One-stop Create and upgrade Tourism Projects

Key words: