A new park opens again! How iQIYI, valued at tens of billions, advances towards the trillion-dollar Disney

Source:

Author:

Release time:

2025-08-21

Click to view details

CAAPA Key Cultural and Tourism Event Recommendations

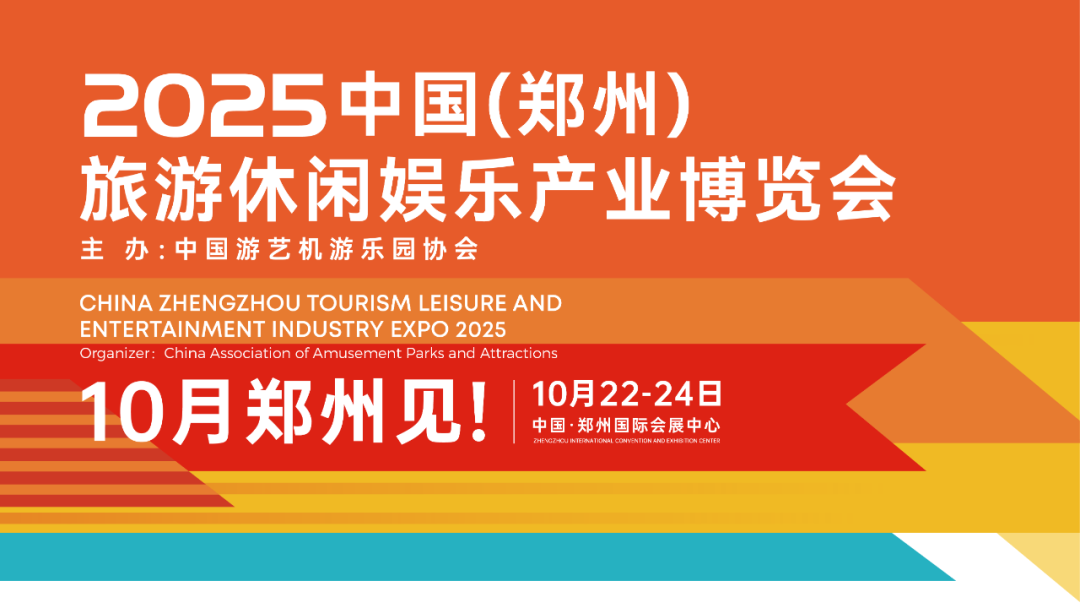

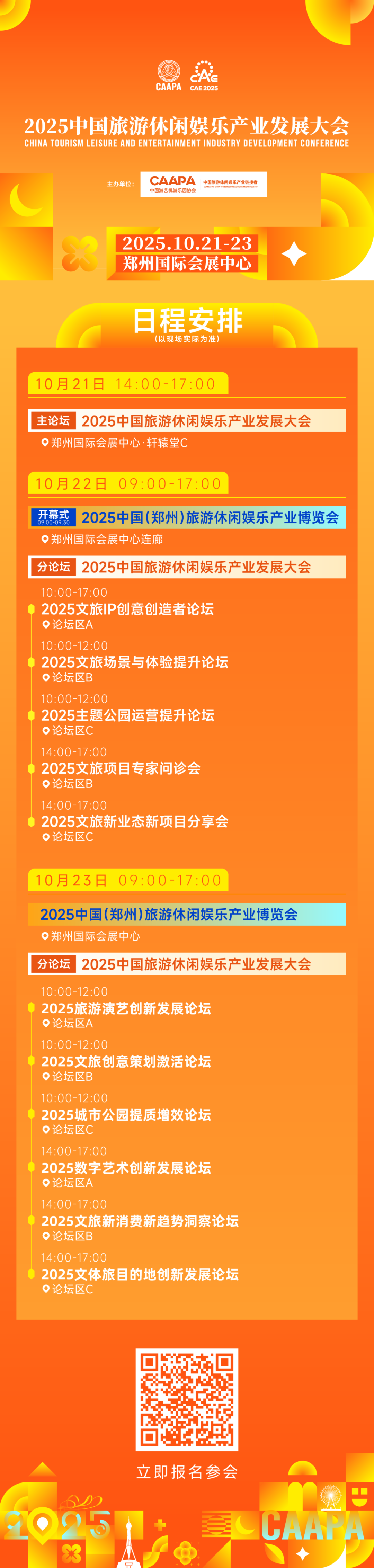

2025 China (Zhengzhou) Tourism, Leisure and Entertainment Industry Expo

2025 China Tourism, Leisure and Entertainment Industry Development Conference

▲

Author | CAAPA Contracted Author

Editor-in-Chief | Yang Ming

Editor | Liu Kaiye

Yesterday, at iQIYI's Q2 2025 earnings call, iQIYI founder and CEO Gong Yu stated, "Currently, besides the offline parks in Yangzhou and Kaifeng, there may be one or two more confirmed by the end of the year."

From Wanda and Huayi to Pop Mart and iQIYI, over the past decade, countless companies have intentionally or unintentionally benchmarked Disney, each gaining varying degrees of experience, lessons, or growth through this benchmarking.

In 2018, Gong Yu publicly stated for the first time, "Our business model is more like Disney." To date, iQIYI has been on a seven-year path of IP ecosystem development. This long-video platform, once regarded as the "Chinese Netflix," is attempting to build its own entertainment experience empire through offline parks, IP merchandise, and immersive theaters. At this time, iQIYI and Disney's market values are approximately 16 billion RMB and 1.5 trillion RMB respectively, a difference of about 100 times.

Strategic Positioning: From "Chinese Netflix" to "Disney"

iQIYI was initially often compared to Netflix by outsiders. But Gong Yu realized early on that simply imitating Netflix was a dead end. In 2018, he clearly stated: "Compared to Netflix, our business model is more like Disney." Netflix's model is simple and easy to replicate but difficult to sustain growth in the Chinese market.

iQIYI Park

In 2019, Yang Xianghua, President of iQIYI Membership and Overseas Business Group, further explained this view: "iQIYI's business model is more like Disney's, with one-third media platform, one-third parks, and one-third derivative commercial income."

Behind this shift in positioning is the pursuit of maximizing IP value. Disney's business essence lies not in how much content it creates, but in how an IP is monetized through multiple channels—films, merchandise, theme park experiences.

Business Layout: Building a "Multiple Revenue Streams" Ecosystem Model

iQIYI is practicing the so-called "multiple revenue streams" business model, monetizing IP value through various channels. Membership and advertising, as traditional mainstays, face revenue decline pressure starting in 2024, accelerating iQIYI's pace in developing new businesses.

iQIYI's IP experience business is divided into IP merchandise and offline experiences. The IP merchandise business is currently becoming an important breakthrough for iQIYI. Starting from licensing into the card market in 2018, to testing live-action film cards with "Lotus Tower" in 2023, and achieving full self-operation of cards by July 2024. In the first half of 2025, its self-operated film card GMV (transaction amount) has exceeded 100 million RMB.

Offline experience business is divided into immersive theaters and offline parks. According to reports, "immersive theaters are a light-asset model, each store invested and built by partners, currently operating in over 30 cities with 50 stores. iQIYI parks also use a light-asset approach. The heavy-asset model involves local enterprises investing and building, with iQIYI providing content, management, and technology."

Offline Expansion: Exploration and Innovation of Theme Parks

Unlike Disney and Universal Studios focusing on first-tier cities, iQIYI's first theme park project is located in Yangzhou, part of the 8.079 billion RMB Yangzhou "Canal City" project. According to plans, iQIYI Park will consist of seven major sections: immersive theater, holographic light and shadow space, immersive performance theater, film set interaction, NPC interactive experience, party moment MR games, and themed events, planned to open within this year.

It is revealed that this choice was carefully considered: Yangzhou attracts over 100 million visitors annually, with a growing proportion of young visitors and increasing overnight stays. iQIYI's tech-based theme park complements other cultural tourism projects in the region, promoting mutual enhancement and better agglomeration effects.

iQIYI's theme parks differ from traditional ones. They emphasize using film and TV IP, virtual reality, and other technologies to achieve smaller scale, immersive, and highly interactive theme parks.

This concept is confirmed in another iQIYI park project announced in April, the "960 Cultural and Creative Park" in Kaifeng. This project, in cooperation with Kaifeng Cultural Investment Group, is built in three phases, including a park, themed hotel, and Guochao commercial street. The first phase park project is expected to invest about 8.4 million RMB, featuring "immersive experiences integrating Chinese film and TV IP with cutting-edge digital technology," aiming to create a comprehensive park combining entertainment, leisure, and cultural experience.

Qibaba Park

Actually, as early as 2023, Qliday Production, the exclusive operator licensed by iQIYI for Qibaba Park, jointly created the first offline parent-child theme park with Beijing Expo Company at the Beijing Yanqing Expo Resort. The park covers nearly 6,000 square meters, has seven themed spaces, over 200 play projects, and introduced two self-produced animation IPs, "Dudangman" and "Dinosaur Adventure," targeting families with children aged 3-12. This cooperation can be regarded as iQIYI's initial attempt to enter offline parks.

Challenges and Gaps: From iQIYI to Disney

iQIYI's entry into theme parks will inject fresh momentum into the industry in technology application, membership ecosystem, IP operation, and traffic conversion. To advance to Disney's level, iQIYI must set clear development goals, recognize gaps, and formulate strategies.

"Tang Dynasty Strange Stories" Immersive Theater

Content IP is Disney's core asset. iQIYI has accumulated rich film and TV IP resources over the years, including hit works like "Wind Rises in Luoyang," "Cang Lan Jue," and "Tang Dynasty Strange Stories." These IPs have large fan bases and theoretically can provide potential customers for offline business. However, aside from the quantity gap, the IP themes and "conversion rates" are definitely factors that cannot be ignored.

In many contexts within the tourism industry, "IP" is often equated with brand image; as long as a work or project has a brand, it is considered an "IP." In the author's view, this is the biggest misunderstanding of IP because it obscures the core part that best reflects the value of IP: the extensibility of the story and its cross-platform transformation ability.

Disney's story content can be continuously updated. It uses themes such as family affection, friendship, equality, and love to gain recognition from the largest common denominator of people across different regions and cultural backgrounds. Then, through a team of fantasy engineers, it concretizes cultural stories into experiential and interactive devices, scenes, and activities, thereby breaking down the dimensional barriers between virtual and real, online and offline. However, even Disney has many stories that cannot or should not be transformed into offline experiences, which may provide iQIYI with some experience and inspiration in the reasonable use of IP.

Operational management is the core capability of theme parks. After a century of practice, Disney has formed a mature system in IP transformation, park planning and design, project development and operation, and cooperative ecosystem construction. It is also at the forefront globally in service innovation, event planning, and visitor management. Currently, iQIYI is only exploring theme parks as a second growth curve. To develop maturely and even form a synergistic ecosystem, there is clearly still a long way to go.

iQIYI Senior Vice President Zhang Hang once stated: "From Disney's financial reports, the experience business (theme parks and IP derivative licensing) accounts for a very high proportion of Disney's revenue and profit, and we internally take this as a goal." "At this stage, the team will spend more effort on the initial park products and operational refinement, using the rapid iteration thinking of the internet and the pursuit of ultimate experience to first ensure the success of the initial park operation."

It can be said that, From the hundred-billion-level iQIYI to the trillion-level Disney, iQIYI is taking a crucial step forward. Of course, iQIYI does not necessarily want to become a copy of Disney. It hopes to truly explore its own path: using the rapid iteration thinking of the internet to create an immersive entertainment Chinese model that integrates digital technology and film and television IP.

Come here ↓ to discover new trends in cultural tourism

Join over 1000 leading cultural tourism enterprises in a grand event

See you in Zhengzhou, October 21-23!

Key words: