Labubu Takes the World by Storm: The "Quirky" Charm Behind the Rise of a New Generation of Super IP

Source:

Author:

Release time:

2025-06-04

Click to view details

Against the backdrop of the rapid development of the global trendy toy market, Labubu, a Chinese trendy toy IP, has rapidly risen to become a global phenomenon thanks to its unique design and cultural connotations. From the midnight queues in Los Angeles to the buying frenzy in London, from celebrity endorsements to social media buzz, Labubu's global popularity has attracted widespread attention. What is it about this "ugly-cute" little monster that makes it so attractive?

"The recent state of North Americans going out: walking Labubu!"

From the long lines starting at 3 AM in Los Angeles, to the chaotic fights that broke out in London stores due to the rush to buy; Lisa, the Thai princess, Rihanna, and Beckham treat Labubu as a fashion accessory.

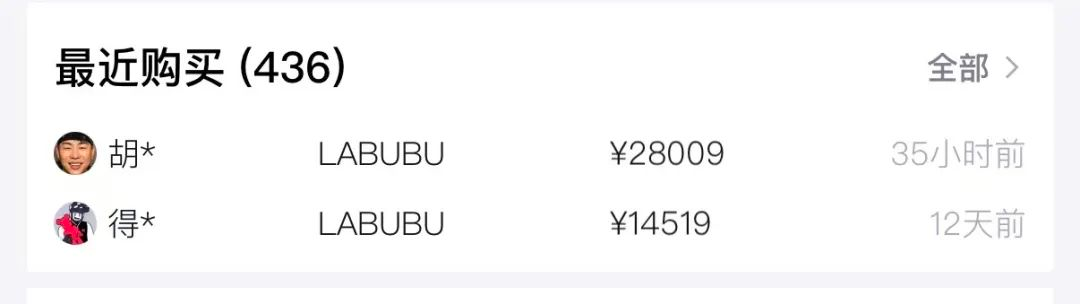

Chinese male star Hu Yibin offered an exorbitant price to buy it News about Labubu has sparked heated discussions across the internet...

It has gained 300,000 fans on TikTok, with limited edition prices being inflated to five times their original price, becoming a new generation of "social currency" sweeping across Europe, America, and Asia.

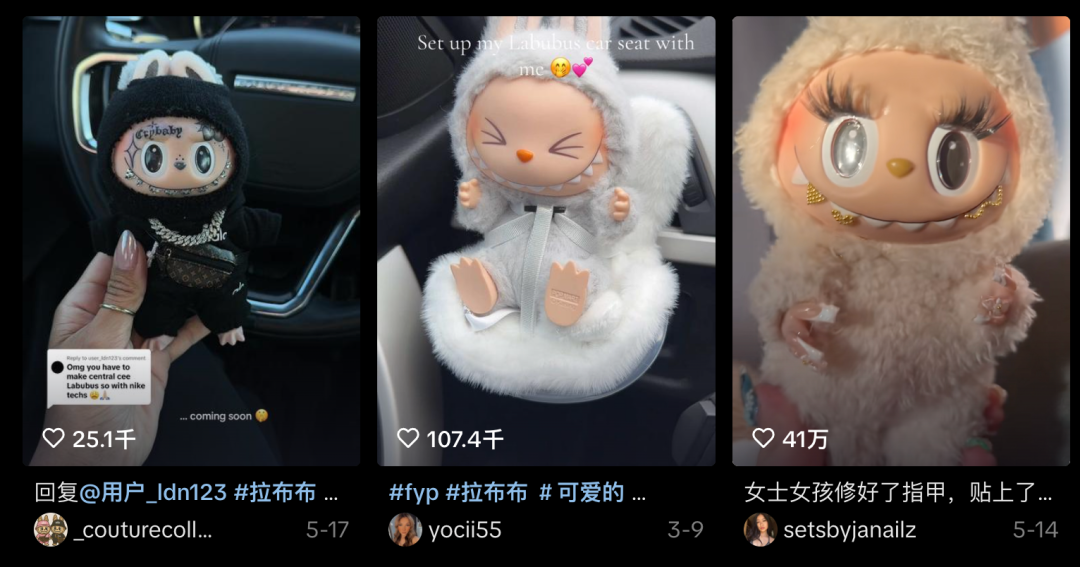

Netizens have started a Labubu modification trend, adding rhinestones to Labubu, giving it Kardashian-style butt enhancements, and dressing it in various trendy outfits...

Businesses have started "doing abstract," creating a wave of Labubu with crooked faces and bald heads, and AI-generated Labubu videos are also very popular.

Unable to get Labubu, North American netizens have begun to turn their attention to counterfeit products like Lafufu, Lababa, and Labobo, and showing off their fake products and competing in ugliness has become the latest traffic password.

This little monster that breaks the stereotype of cuteness, "weird kid," why can it become popular from Southeast Asia to the world, and even be hailed by JPMorgan Chase as "the next Hello Kitty"?

The phenomenon-level craze caused by the "nine-toothed monster":

The new king of globally sought-after "social currency"

At 2 AM outside the Beverly Center in Los Angeles, hundreds of young people lined up, the queue stretching around three blocks. They weren't waiting for the latest iPhone or limited-edition sneakers, but for an ugly-cute little monster from China—Labubu.

With bags full of Labubu dolls and keychains, a young woman being interviewed by local media said that she had been waiting outside for three hours to buy the pink macaron series Labubu 3.0, "It's really cute."

One netizen even encountered Kylie Jenner's daughter Stormi, who ended up buying a luxury blind box.

Labubu became an overnight sensation in the US. Qimai data shows that on April 25th, the Pop Mart app topped the US App Store shopping chart for the first time, jumping 114 places in a single day and maintaining the top spot for two consecutive days. It also ranked fourth in the free overall chart, setting a record for Chinese consumer brands.

Outside of Los Angeles, long lines also formed at Pop Mart stores in New York, Chicago, London, Paris, Milan, and other European and American cities.

At the Pop Mart store in Stratford, London, the scene became chaotic due to the rush to buy Pop Mart products. According to BBC reports, Labubu fan Victoria Calvert witnessed customers lining up at 3 AM. "After the sale started, people were shouting that the Labubu dolls were sold out, and I even saw a fight between staff and customers." She eventually left: "It was terrifying."

Ultimately, Pop Mart suspended the sale of Labubu series products in all 16 stores in the UK, and the suspension is still ongoing.

The reason why Labubu has become popular from Thailand to the European and American markets is the "Exciting Macaron" LABUBU 3.0 series released by Pop Mart at the end of April. The series sold out online instantly upon release.

As the first online launch channel in North America, 20,000 new products in the TikTok Shop livestream sold out instantly, driving the livestream to sell $1.5 million (approximately 10.78 million yuan) in a single session.

POPMART US SHOP jumped to the top of the TikTok Shop US sales chart in April with monthly sales of $6-7 million (approximately 43-50 million yuan).

The Labubu 3.0 series has a basic shape suitable for various pendants, and its bright and bold "dopamine" candy colors have captured the hearts of many European and American consumers.

(Labubu 3.0 series StockX (US) price)

According to the Pop Mart official website, the price of this series in the US and UK markets is more than double that in China. On the second-hand platform StockX, the price of a single blind box of the hidden Labubu has soared to over $1,000, with a price increase of over 100 times, truly deserving the title of "young people's plastic Moutai."

Bank of America Merrill Lynch's latest research report points out that the Labubu 3.0 series has become popular worldwide, with sales in the US and European markets in April increasing by about 8 times and 5 times year-on-year, respectively.

In its latest research report, JPMorgan Chase has designated Labubu as the "next Hello Kitty." Analysts believe that Labubu and Hello Kitty are very similar in character style and business model, and are rapidly rising as a new generation of super IPs and their search popularity has already surpassed Hello Kitty (Google Trends data shows that Labubu's search popularity exceeded Hello Kitty's in May 2025).

JPMorgan Chase expects that the sales of THE MONSTERS series, to which Labubu belongs, are expected to grow from RMB 3 billion in 2024 to RMB 14 billion in 2027, demonstrating its enormous potential as a super IP, showing its huge potential as a super IP in 2027.

Decoding Labubu's Viral Success:

From "Weird Kid" to Global Top-Tier: Three Key Drivers

In fact, Labubu has been around for ten years. This IP belongs to THE MONSTERS spirit group series created by Hong Kong illustrator Kasing Lung of Hong Kong, China.

(Image source: Kasing Lung Instagram account @kasinglung)

In 2019, Pop Mart signed this IP series from Hong Kong illustrator Kasing Lung, but it didn't initially gain widespread popularity. In 2022 and 2023, the revenue of THE MONSTERS series was only RMB 263 million and RMB 368 million; the turning point occurred in 2024, when the series' revenue first exceeded RMB 3 billion, a year-on-year increase of 726.6%.

That year, Pop Mart achieved revenue of RMB 13.04 billion, and THE MONSTERS series became a true "flagship product."

The primary reason Labubu became a top global IP is its subversive charm; "weird" is its appeal.

"Having dodged LinaBell's cute attack and Jellycat's soft and cuddly offensive, I ultimately couldn't escape Labubu's mischievous smile." From its appearance, Labubu's "impish strangeness" breaks the conventional stereotype of cute dolls, becoming a significant factor for many fans to get hooked.

A pair of rabbit ears, a pair of innocent big eyes, baring nine sharp teeth, with a fierce yet mischievous smile, a hint of innocence in its cuteness. It looks a bit "weird" and a bit "gloomy" nine-toothed child, resonating emotionally with today's young people.

"Some people ask me if it's childish to still play with dolls in my thirties, but in my eyes, this grinning, crooked-toothed little one is using the most exaggerated expression to resist the world's norms." Lili, a post-90s office worker, said that her desk is always neatly adorned with carefully dressed Labubus. In her opinion, Labubu's significance far exceeds the healing feeling brought by cute dolls; it also motivates her to bravely resist workplace PUA.

Kasing Lung once mentioned in an interview that the inspiration for creating Labubu came from being deeply inspired by the whimsical creatures in Nordic mythology, wanting to create a non-conformist character with a unique personality. "I hoped it would be more than just a doll; it could represent the unknown side deep within young people. I never expected it to receive such an enthusiastic response."

As Kasing Lung wished, today, the anthropomorphized Labubu has become a spiritual solace for young people.

Office workers entrust their emotions through ritualistic behaviors such as specific placement and regular wiping, viewing it as an "energy guardian."

Secondly, the celebrity effect and fashion crossover, leading the trend from trendy toys to luxury accessories.

In April 2024, BLACKPINK member Lisa frequently posted photos of Labubu on Instagram, igniting interest from hundreds of millions of fans, and later expressed her affection for Labubu on various public occasions.

After Lisa popularized Labubu, a Thai princess appeared at Paris Fashion Week carrying a Hermès bag adorned with Labubu. Subsequently, Labubu was invited to travel to Thailand as a "Magical Thailand Experience Officer."

Furthermore, in a Thai telecom fraud case, Labubu even appeared alongside various luxury goods in the display of ill-gotten gains of two telecom fraud masterminds, further deepening its "luxury item" label.

This year, in February, Rihanna was spotted at Los Angeles Airport with a pink Labubu "bag charm," jokingly referred to by netizens as "Labubu successfully conquering America." With the entry of North American celebrities, Labubu's popularity soared from Thailand all the way to the North American market, and its value skyrocketed accordingly.

"Carrying a Hermès crocodile leather Birkin bag worth hundreds of thousands on the street isn't cool enough; hanging a hundred-yuan Labubu bag charm is the real trend." Labubu's top-tier status in the fashion world is now unshakable. Just hanging Labubu as a charm on a luxury bag isn't enough; matching outfits must also be put on Labubu.

Furthermore, the viral spread of UGC (User-Generated Content) on social media also fueled Labubu's popularity.

In the American market, rich in West Coast culture, Labubu was adorned with rhinestones bearing Rapper logos; fashion trendsetters in the North American market even went so far as to give Labubu "Kardashian-style" butt lifts and attach colorful false eyelashes to show off their personalized fashion tastes; resourceful netizens used various makeup products to change Labubu's skin and fur color...

On TikTok, #Styling My Bag with Labubu has over 1.1 million posts.

numerous overseas users spontaneously created Secondary creations such as "Labubu's Transformation Show," "Labubu Immersive Unboxing," and "Labubu Complaint Conference" have created a phenomenal spread effect, generating significant buzz. #LabubuHaul The (unboxing) video playback has exceeded 1 billion views.

(Source: Tiktok blogger @sofiapetrillo)

On An Ins blogger received 221,000 likes for their handmade crocheted "Labubu" creations. In the video, they shared that they were publicly soliciting names for their creations, and a highly-liked comment suggested, "Please name them delulu and tell them I love them."

(Source: Ins blogger @kevinyeedotcom)

This trend of showcasing "ugly" things has also spread on Chinese internet social media. On social media platforms like Xiaohongshu, many netizens have posted pictures of strangely shaped "Chinese version of Labubu," creating a chaotic scene.

Among them, the bald-headed Latutu is quite popular. Even more bizarre is that Labubu has become associated with metaphysics.

On Xiaohongshu, the topic "Labubu Wishing Wall" has over 500,000 posts. People are resorting to metaphysics to get their desired Labubu blind boxes.

Taking Labubu to temples to pray for blessings, and even consecrating Labubu has become a metaphysical trend.

In Hong Kong, Labubu has also engaged in cultural fusion performance art. In a recently circulated video of a Hong Kong Cantopop diva's birthday banquet, Mokoko from the Labubu family transformed into a "Heavenly Empress," wearing a dragon robe, holding a scepter, and adorned with a "招财进宝" (Zhaocái Jìnbǎo - "Inviting Wealth and Treasure") pendant. One netizen commented, "The noble Mokoko has become a god!" Another added, "The world will eventually be ruled by Labubu."

In Hong Kong street shops, Labubu is displayed prominently, acting as a kind of shop guardian.

Globalization Strategy:

Seeking growth in the Southeast Asian market

Seeking brand power in the European and American markets

Labubu's global popularity is no accident. When creating this IP, Pop Mart took "human touch" marketing to the extreme and combined it with a deep global localization strategy, together building a powerful "Labubu universe."

First, it's about giving it a soul 。As a top star, Labubu not only has personal social media accounts and an exclusive single, but also frequently "attends" major events, receiving the treatment of a top star. The Xiaohongshu official social media account "LABUBU has nine teeth" now has 77,000 followers.

In addition, the Labubu 3.0 series gives each color a unique personality and name: Luck, Happiness, Loyalty, Tranquility, Hope, Love, and True Self, further strengthening the character's personality and story, making the IP more vivid and immersive.

The immersive experience created in offline parks further deepens the interaction between stars and fans 。The Beijing Pop Mart City Park uses Labubu and the Elf Squad as core interactive characters, creating phenomenal topics through offline activities such as "Labubu's Song" and "Elf Cheerleading," deepening fan emotional connections.

Pop Mart also plans to create animated shorts for Labubu and Starry People, transforming the IP from toys into characters with stories, making Labubu, like Disney characters, a source of emotional companionship for global consumers.

Secondly, Pop Mart's localization efforts in entering overseas markets have been very successful.

In its overall marketing strategy, Pop Mart has abandoned rigid cultural output, instead using "localized creation" to break down cultural barriers.

First, it uses collaborations with globally renowned IPs to increase brand awareness in the local market. When entering the Southeast Asian market, Pop Mart collaborated with Minions, Sanrio, and other globally renowned IPs. After these IPs boosted Pop Mart's popularity, it launched the CRYBABY series.

Entering the European and American markets, Pop Mart used the same logic, using Molly and Labubu as the main characters, collaborating with internationally renowned IPs such as Disney and Harry Potter to continuously attract customers to offline stores. In store displays, Disney derivatives and co-branded products are placed in prominent positions, leveraging familiar local IP images to increase brand awareness in the local market.

(Pop Mart's Louvre Museum store in France)

On the occasion of the opening of its first store in the Louvre Museum in France, Pop Mart also launched derivative products combining Labubu with world-famous paintings, the Labubu's Artistic Quest Louvre limited edition series. Pop Mart officials revealed that this year, they plan to collaborate with the Louvre again, with their IP

As China's largest trendy toy IP company, signing global high-quality trendy toy designers and obtaining IP authorization for incubation is Pop Mart's main model. Pop Mart's chairman and CEO Wang Ning likens this method to a "record company," finding musicians, recording their music, and selling it worldwide to achieve true scale and commercialization. According to public reports, as of 2024, Pop Mart has 73 artist IPs.

The wildly popular CRYBABY in the Thai market comes from the works of Thai artist Molly Yllom, while in the North American market, Pop Mart signed American artist Libby to create the punk-style IP Peach Riot series, which has become a hit in North America.

In addition, the tourist population and the resident Latin American community in Miami and Orlando (where Disney is located) brought Pop Mart unexpected revenue. Local consumers prefer brightly colored IPs, and sales of the Labubu fruit series have surged. IP, Labubu fruit series sales soared.

In order to achieve sufficient localization, Pop Mart has made great efforts in personnel recruitment. It is understood that in Pop Mart's overseas team, more than 90% are locals. In addition, Pop Mart's regional business is established and managed by recruited foreign regional general managers, even planning key businesses such as store openings and marketing.

Wen De Yi revealed in a public interview video that basically 70% to 80% use domestic standard processes, while the remaining 20% to 30% of the space is left for the local team to improve and develop.

Furthermore, when entering the overseas market, Pop Mart adopted a more flexible market strategy. It first tested the waters online through cross-border e-commerce, then increased its brand awareness through collaborations with international IPs, and then promoted core IPs within the region through pop-up stores. Only after successful trials did it expand its directly-operated stores.

2024 was Pop Mart's fastest year for overseas store openings, with 50 new stores opened, all of which were directly operated stores. As of December 31, 2024, Pop Mart had 130 stores (including joint ventures) in Hong Kong, Macao, Taiwan, and overseas, and 192 robot stores (including joint ventures and franchises).

Today, in Pop Mart's overseas market, revenue from offline channels has become the main revenue pillar for Pop Mart's overseas business. The financial report shows that in 2024, Pop Mart's overseas offline revenue reached 3.071 billion yuan, an increase of 379.6%, accounting for 23.6% of Pop Mart's total revenue.

Looking at Pop Mart's overseas business, the Southeast Asian market, represented by Thailand, is now a well-deserved pillar. Pop Mart 2024 annual report shows that the Southeast Asian market achieved revenue of 2.4 billion yuan, accounting for 47.4%, a year-on-year increase of 619.1%, making it the region with the highest revenue share and the fastest business growth.

Wen De Yi, Vice President and President of International Business of Pop Mart Group, revealed in an interview with the podcast "High Energy" that the first day's performance of the first store opened in Thailand in September 2023 was 10 times the average of all stores. In less than 6 months, Pop Mart opened 3 more stores in Thailand. "I knew the Thai market was a dark horse, but I didn't expect such explosive growth." Currently, Pop Mart has 6 offline stores in Thailand, and sales are almost always among the top ten globally.

It is worth mentioning that the European and American market, a "tough nut to crack," has also grown impressively, especially the North American market, whose growth rate is approaching that of Thailand, has become its second growth curve overseas. According to Pop Mart's 2024 annual report, Pop Mart's revenue in the North American market in 2024 increased by 556.9% year-on-year, and Europe, Australia, and other markets also achieved a year-on-year growth of 310.7%.

Currently, Pop Mart has 26 stores in the North American market. In the first quarter of 2025, the revenue in the North American market has approached the annual revenue of the region in 2024. Pop Mart founder Wang Ning said at the financial report meeting that the North American market is expected to reach the group's total sales in 2020, which is 2.513 billion yuan, with no less than 50 stores.

In the North American market, the daily 100,000+ orders of explosive growth in demand are supported by Pop Mart's strong supply chain.

Pop Mart's "three continents and five warehouses" system built in Mexico, Poland, and Vietnam operates efficiently, compressing the delivery cycle from 6-8 weeks to 7 days, providing a solid backing for 72-hour direct delivery of North American orders.

The successful entry into the European and American markets for Pop Mart, in addition to the intuitive display in revenue, is more important in terms of brand awareness. After all, most of the world's well-known luxury brands originated in the European and American markets. If Pop Mart can carve out a path in the competitive European and American markets, it will add a strong stroke to the globalization process of Chinese trendy toy brands.

Pop Mart's high pricing in the North American market has further broken the stereotype of Chinese brands being "low-priced," and is also a new breakthrough for Chinese brands in gaining pricing power in the high-end market.

From a commercial perspective, the rapid advancement of overseas business has also injected a strong stimulant into Pop Mart. Compared with the domestic market, the gross profit margin of overseas business is higher, and it is also an important profit growth point for Pop Mart. In 2024, Pop Mart's overseas market gross profit margin reached 71.3%, while the gross profit margin of the Chinese mainland market was 63.9%.

Looking back to the day Wen De Yi joined the company, Wang Ning once told him that he hoped that Pop Mart Group would have 50% of its sales from overseas, and said, "I'll give you five years to surpass me."

According to Pop Mart's latest annual report, in 2024, the revenue share of Pop Mart's Hong Kong, Macao, Taiwan, and overseas business has reached 38.9%. In three years, Pop Mart's overseas revenue has soared from 454 million yuan to 5.066 billion yuan, an increase of ten times, and has become a new growth engine for Pop Mart.

Wang Ning revealed the overseas market target at the performance release meeting: hoping that overseas sales will exceed 10 billion yuan in 2025, and achieve 100% growth.

With the continuous growth of Pop Mart's overseas business, its globalization strategy has been upgraded again. This year on April 14, Wang Ning announced the launch of adjustments to the company's global organizational structure, setting up regional headquarters in Greater China, the Americas, Asia-Pacific, and Europe. Wen De Yi will concurrently serve as the group's co-COO, responsible for the Asia-Pacific and European regions; COO Si De will be responsible for Greater China and the Americas.

The road to rapid development is not without its challenges. The supply chain challenge of "difficulty in buying goods" is a hidden reef that the Labubu empire must face directly. According to media reports, to buy Labubu in Seoul's Myeongdong today, you need to queue up the night before; three stores in Osaka, Japan, have posted notices suspending the sale of Labubu. The suspension of sales of the Labubu series in the UK market has also resulted in some damage to consumer experience. In addition, the proliferation of counterfeit products such as Lafufu, Lababa, and Labobo, and the phenomenon of "showing off fake and ugly things" on overseas social media, are eroding brand value and the genuine product market, which deserves attention.

Next, whether it can continue to optimize supply, defend brand value, and precipitate a truly lasting emotional connection and cultural symbol in the wave of popularity will be a key test for Pop Mart and Labubu's transition from a phenomenal "hit" to an eternal "classic".

Recommended Important Cultural and Tourism Events

2025 China Parent-Child Tourism Innovation Development Forum

June 12-13, Shanghai Jinshan Crowne Plaza Hotel

Key words: